Back to Basics: Compliance Reviews

At any given time, Low-Income Housing Tax Credit (LIHTC) properties all over the country are helping tens of thousands of households by providing decent, safe and sanitary affordable housing. A property can continue to do so if the responsible management professionals follow the basic rules of the program.

Past articles in this series discussed building a library to assist in understanding the compliance rules, as well as specific rules relating to determination of income and student status for the LIHTC program. This article will cover how the government ensures that properties are compliant and how to get ahead of this process to fix any problems that arise. Specifically, the article outlines how LIHTC properties are monitored by the government through regular inspections and how LIHTC professionals can be prepared for visits from regulatory monitors even before being notified.

Inspection Basics

The IRS delegates the task of conducting regular visits to LIHTC properties to state Housing Finance Agencies (HFAs). Each state has an HFA. Among other tasks, the HFA visits each property in its state at least once every three years. The IRS expects the HFAs to monitor and interpret the federal rules and allows them to impose rules beyond the federal requirements, so it is important for new LIHTC professionals to get familiar with their state HFA. They should also locate and familiarize themselves with any state HFA LIHTC compliance manual, FAQs or newsletters. This helps management know how to meet the state agency’s requirements and will help make visits from the state go smoothly. States report noncompliance they find to the IRS on form 8823. The IRS’ 8823 Guide provides instructions to the HFAs for completing this form and is very useful in understanding the IRS’ expectations for LIHTC properties.

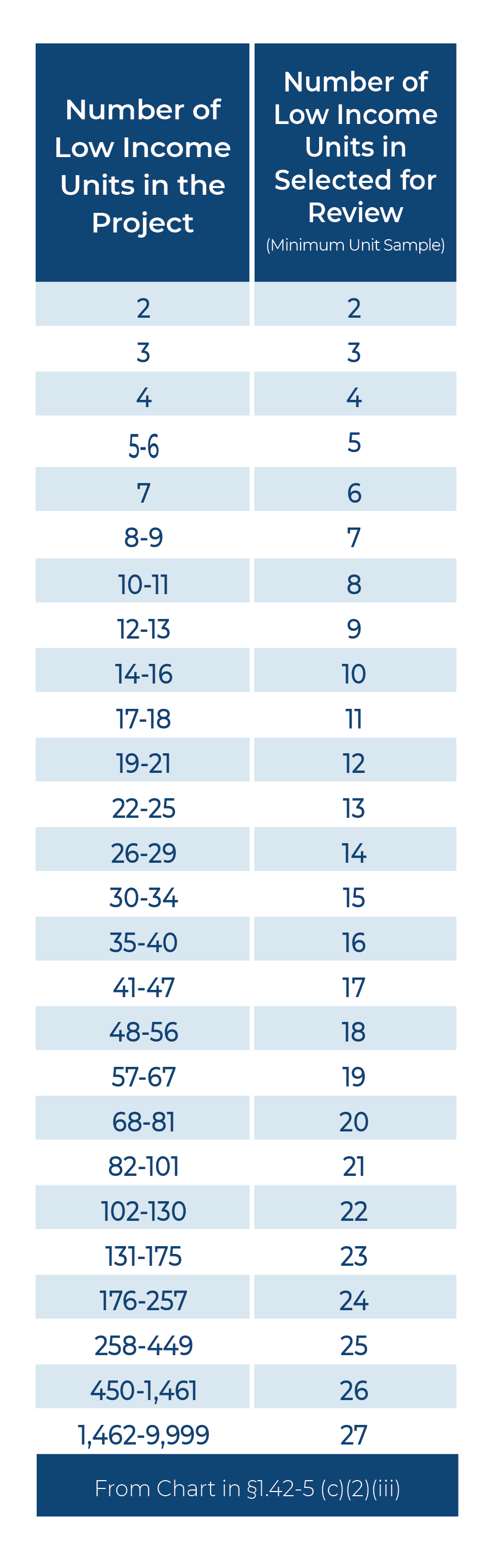

On their triannual visits, the state HFA will review tenant files, and check the physical condition of the property and units. In the past, the requirement was that a minimum of 20% of the LIHTC units (rounded up to the next whole unit) had to be reviewed, and the same units had to be chosen for file and physical review. In 2016, the minimum standard was temporarily adjusted to the lesser of the 20% or the number on the new chart to the right. Analysis of the numbers show that the minimum was 20% of the LIHTC units until a project has 105 units. After that, the new chart provides a lesser minimum of unit. As noted below, this standard was reinstated in 2020.

Except for properties with HUD or Rural Development funding, physical inspections will be conducted using the HUD standard Uniform Physical Conditions Standards (UPCS) protocol OR a local code. UPCS is part of the HUD REAC physical inspection system. HUD provides UPCS documentation on its website that explains that protocol.

The final compliance monitoring regulation, published in 2019, eliminated the 20% aspect of the rule, and states were required to pick a minimum sample size based on the chart. This would have substantially increased the percentage of units inspected for smaller properties. This met with substantial objection in the industry and the IRS listened. In July 2020, it re-instituted the 20% ceiling. The new regulations also no longer required that the state HFA examine the same units when conducting the file reviews and physical inspections. If units that are selected do not cover all buildings, the HFA must select some aspect to inspect of each building that will not have any units inspected. These can be building exterior, HVAC or similar. An exception exists for properties monitored by HUD REAC inspections, which may use the REAC sampling methods. This means that often all buildings are not inspected. The HFA may not inform the owner which units will be inspected prior to the day of the inspection. Finally, the reasonable notice time that states are allowed to give of an upcoming inspection has been reduced from 30 days to 15. All of these provisions remain in the final rule.

Here are some helpful hints to help a manager prepare for a visit from the HFA:

- Arrive on time for the audit and have all files on hand.

- Have a place prepared for the reviewer to review files. Having adequate light and a surface to work on is important. Even a folding table in a laundry room is better than nothing at a property without office or community room space.

- Find out if the auditor prefers the manager to stay close at hand to answer questions or would rather they wait to answer all their questions at once. This is a matter of individual auditor preference.

- Notify all residents of the physical inspection, giving sufficient time under the property lease and state law. Also, have keys on hand for all units. If the inspector cannot legally enter units, the state HFA is very likely to declare the units noncompliant.

- Do not be defensive or argumentative. Make sure that all interaction with the reviewer is professional. If the auditor is wrong on a point, a chance to dispute the point will come when the written report is received later. Many incorrect findings also disappear before the letter is written once an auditor has a chance to do some research of their own. Getting into a conflict does not serve anyone’s interests.

- Respond quickly to health and safety issues, and inform the HFA immediately when these are addressed. The inspector will provide the timeframe for corrections, generally 24 to 72 hours.

- The HFA may send the report to the owner or a key person at the property management company, and they may not be the site manager. The site manager should make sure that they ask this person if the letter has arrived regularly until it comes. This prevents unnecessary delay in getting started on the fixes.

- If the auditor conducts an exit interview, begin corrections as soon as possible. If not, work should begin as soon as the letter is received. The state is required to give a limited time for corrections to be made before a form 8823 must be submitted to the IRS.

Due Diligence and File Audits

To maintain compliance, the IRS emphasizes the need for due diligence. Chapter 3 of the 8823 Guide explains that “compliant behavior can be demonstrated when a LIHTC property owner exercises ordinary business care and prudence in fulfilling its obligations. Due diligence can be demonstrated in many ways, including (but not limited to) establishing strong internal controls (policies and procedures) to identify, measure, and safeguard business operations and avoid material misstatements of LIHTC property compliance or financial information.”

The guide explains that internal controls include:

- Separation of duties,

- Adequate supervision of employees,

- Management oversight and review (internal audits),

- Third-party verifications of tenant income,

- Independent audits, and

- Timely recordkeeping.

Note the importance placed on internal and external audits commissioned by the owner. Each of the measures on the list relates in some degree to these types of file reviews. Smart owners incorporate file review systems into their procedures or contract with the assistance of a reputable compliance firm. This can include audits of files prior to household move-in or spot checks of a percentage of current household files. The 8823 Guide also discloses that an 8823 is not to be turned in if an issue is discovered and corrected by an owner/agent prior to the HFA informing of an upcoming audit. This is a powerful allowance, and it is, therefore, important for all professionals to work with company systems designed to provide internal controls and increase the chances that a visit from the HFA will go smoothly.

Scott Michael Dunn, 2019 HCCP of the Year, is the CEO of Costello Compliance and Director of Policy for the Costello Companies. The Costello Companies are developers, builders and managers of affordable housing with clients throughout the country.