Rental prices in Metro Denver up less than one-third the rate of inflation

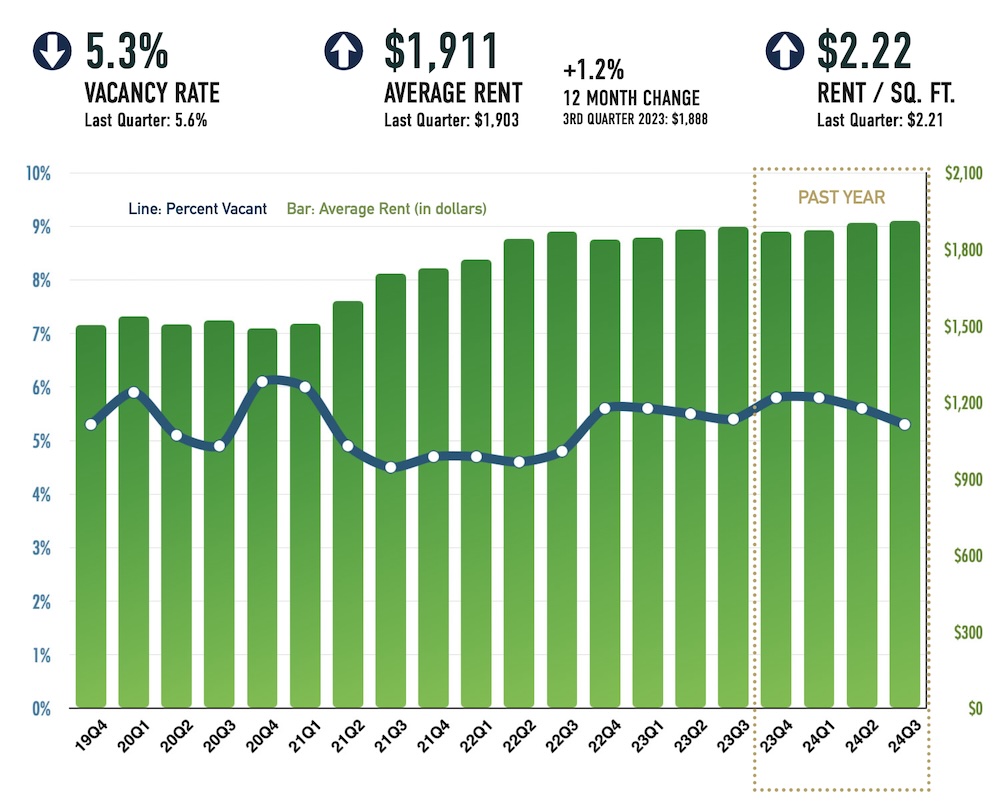

The Apartment Association of Metro Denver (AAMD) released the 2024 Third Quarter Vacancy & Rent Report for the region highlighting a slight 1.2% increase in rents in the past year. This follows a less than 1% increase in the prior 12-month period and falls far below the rate of inflation over the previous 24 months.

“The past two years of extremely low increases in rent is the result of large numbers of new market rate units added to Denver’s housing supply,” said Mark Williams, AAMD executive vice president. “Vacancy offers people housing choices and the increased supply helps depress prices.”

The rent for families in Metro Denver increased an average of just 1.1% in each of the last two years while the Consumer Price Index for All Urban Consumers (CPI-U) for Denver-Aurora-Lakewood increased 3.4% annually over that same time period.

“Across the Denver Metro Area, people are feeling the impacts of inflation when the cost of groceries and gas are on the rise,” Williams said. “The rental housing industry continues to deliver new housing units that the area desperately needs so that rents have not kept pace with inflation.”

The Metro Denver market added 5,139 new rental properties during the third quarter – bringing the total number of new units in the past 12 months to 21,158. That marks a 4.9% annual increase in rental inventory, building upon an already strong second quarter of growth in new apartments, the likes of which has not been seen since the 1970s.

While new construction is at historically high levels, absorption of the apartments coming available has kept up with the need. In the previous 12 months, residents of the Denver Metro region leased 20,395 of those units – filling 96% of the new supply.

“Consumers lose the benefits of the free market when the management and construction of new units are restricted,” said Drew Hamrick, senior vice president of government affairs for AAMD. “We are seeing fewer units planned for the future because builders and operators can't comply with the new restrictions being enforced. Fewer units will eventually destabilize rent prices.”

In the third quarter, the Metro Denver vacancy rate fell 0.3% to 5.3% and dropped in 18 of the region’s 33 submarkets. Denver County’s 5.8% was the highest rate in the region with the city’s Central Business District experiencing the highest rate for a submarket at 6.6%.

Vacancy rates for studio apartments increased to 6.7%, continuing to outpace other unit types and take on a greater share of vacancies. That marks 15 consecutive quarters that studios have carried the highest vacancy rate in the Denver area. All other unit types experienced decreases in vacancy led by a 40-basis point drop for one-bedroom units to 5.5%.

These numbers were compiled by Apartment Insights, which collected data from 242,521 apartment homes.